Xunce, KKR-Backed Asset Data Management Firm, Files for IPO in Hong Kong...

原创 Mae | 2024-03-25 10:42

【数据猿导读】 In August 2023, the Chinese government's approval to recognize data assets as intangible assets and inventories on corporate financial statements marked a pivotal moment. ...

In August 2023, the Chinese government's approval to recognize data assets as intangible assets and inventories on corporate financial statements marked a pivotal moment.

This endorsement prompted a significant shift towards utilizing real-time data infrastructure, transforming data into intangible assets to be included in the balance sheet. Consequently, the size of the real-time data infrastructure and analytics market in China has experienced rapid growth.

Riding the wave is Shenzhen Xunce Technology Co., a provider of real-time data infrastructure and analytics solutions backed by Goldman Sachs, KKR and Tencent.

On March 12, 2024, this company, which specializes in serving asset management companies, applied for an initial public offering (IPO) on the Hong Kong Stock Exchange. Founded in 2016, Xunce currently manages data for more than 250 companies, with a total of more than $10 trillion in assets under management.

However, despite its notable achievements, the company remains in a loss-making position due to ongoing investments in research and development and expansive business strategies.

Aggregate Disparate Data Within Milliseconds

Traditional data systems depend heavily on manual labor and are subject to delayed updates and human errors. Legacy solutions tend to be a collection of individual solutions from dispersed vendors that are designed to address specific tasks or problems, resulting in disconnected systems, data silos and cumbersome workflows.

This mismatch between enterprises’ emerging demand for more advanced data technology and outdated traditional data technologies, plus a series of favorable policy supports, has led to the rapid growth of the real-time data infrastructure and analytics market in China.

Since 2020, when China officially recognized data as the fifth major factor of production in Opinions on Building a More Comprehensive Institutional Mechanism for the Market-based Allocation of Factors, there has been a significant push at the national level to foster the development of a data-driven market, supported by a series of pivotal policies including the 14th Five-Year Plan for the Development of the Digital Economy and the Opinions on Building a Data Base System to Better Utilize the Role of Data Elements.

In August 2023, the General Office of the Ministry of Finance issued the Interim Provisions on Accounting Treatment Related to Enterprise Data Resources, which became effective on January 1, 2024, recognizing data assets as intangible assets and inventories in corporate statements of financial position based on relevant accounting principles. To record data as assets on a financial statement, enterprises must first convert the data into data assets that can be applied to business scenarios through data technology such as the real-time infrastructure and analytics systems.

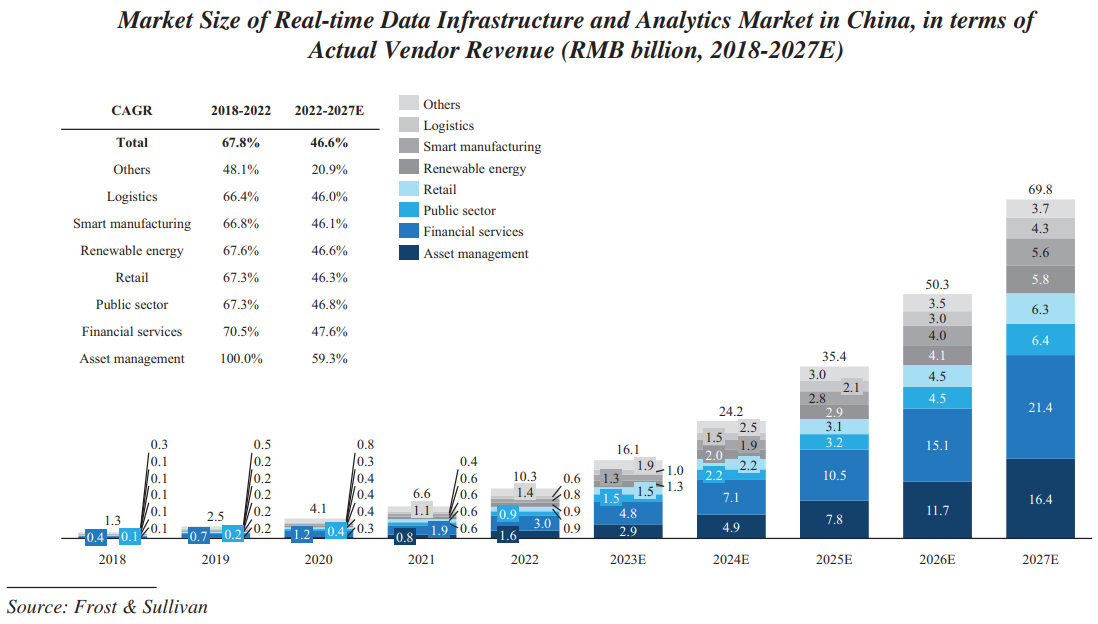

The real-time data infrastructure and analytics market in China is poised for continued growth, forecasted to reach RMB 69.8 billion by 2027, with a compound annual growth rate (CAGR) of 46.6% from 2022 to 2027, as projected by Frost & Sullivan, an independent market research and consulting company.

Furthermore, the total addressable market size (TAM) for China's real-time data infrastructure and analytics market reached RMB 373.8 billion in 2022 and is projected to grow to RMB 847.2 billion by 2027. With a 2022 penetration rate of only 2.8%, calculated by dividing the actual market size by the TAM, this sector has significant room for expansion.

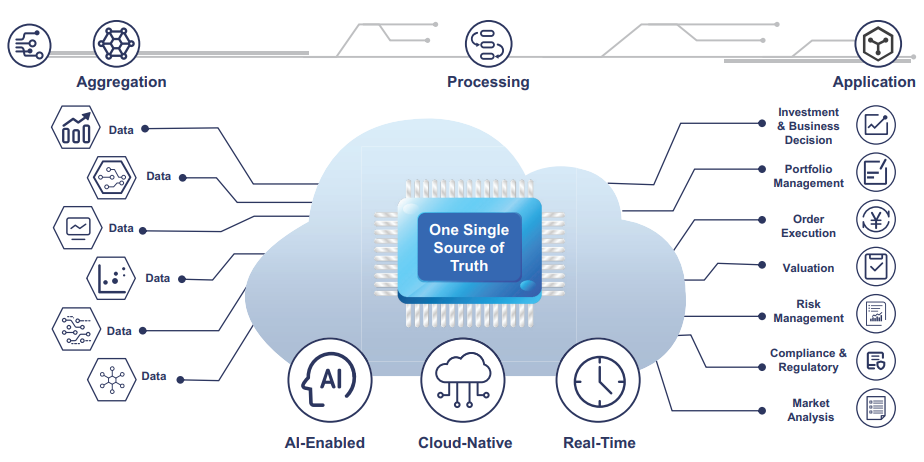

Real-time data infrastructure, which serves as the foundational layer that supports all data-related activities including analytics, is a unified data platform that collects, cleans, manages, analyzes and governs heterogeneous data from multiple sources within seconds.

Data analytics is the application layer that sits on top of this infrastructure, leveraging the collected, stored and managed data to produce insights, make predictions, or inform decisions.

Leveraging big data and AI technologies, real-time data infrastructure and analytics solutions transform dispersed data into business insights by building and analyzing data models, and developing intelligent analytics solutions based on actual business scenarios.

According to Xunce's IPO file, the core of its offerings is a cloud-native, unified data platform that collects, cleans, manages, analyzes, and governs heterogeneous data from multiple sources, deployed in clients’ self-managed cloud or local systems.

Built upon this foundation is the application layer of data analytics, which leverages the underlying infrastructure to produce insights, make predictions, or inform business decisions.

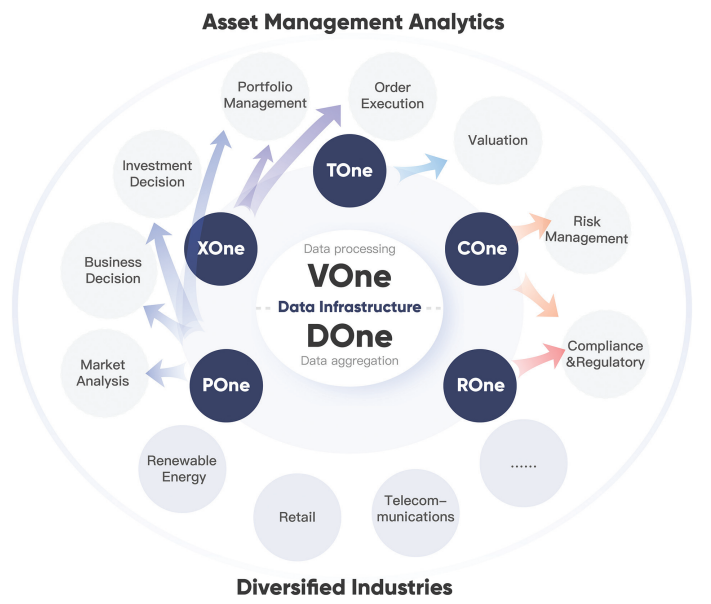

Source: IPO file

Xunce's real-time data infrastructure and analytics system enables enterprises, including asset managers, to aggregate disparate data within milliseconds, presenting a single source of truth. This optimizes critical functionalities from market analysis to risk management, and specialized functions for asset managers such as investment decisions, portfolio monitoring, valuation, and compliance.

The company has introduced two major real-time data infrastructure solutions:

DOne, launched in 2018, is a real-time data infrastructure solution for raw data, connecting with clients' heterogeneous databases and serving as an automated, standardized, and visualized data market.

VOne, launched in 2019, preprocesses functions for the application level, including precision data processing, data modeling, data governance, and data indexing, managing data according to business logic to facilitate data analytics across different business units.

What sets Xunce apart is its modularization capability. This feature allows for the creation of bespoke solutions tailored to each client's specific requirements. By selectively integrating modules with distinct functionalities, Xunce can cater to diverse industry applications while ensuring flexibility and customization.

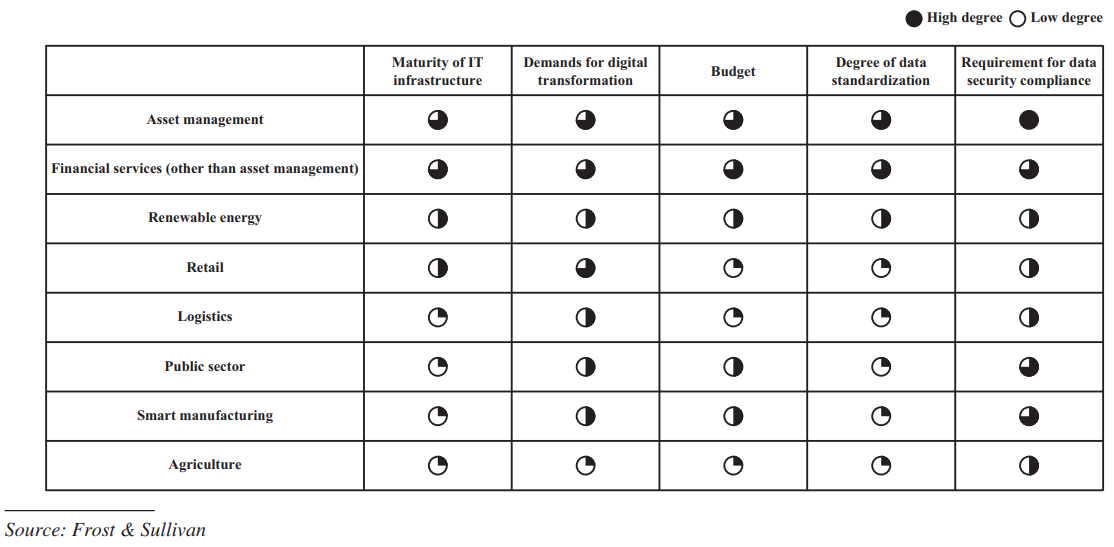

According to Frost & Sullivan, real-time data infrastructure and analytics providers primarily target data-rich industries with complex operations, sizable IT budgets, focus on data asset management, and need for robust data privacy and security measures. Based on these criteria, the asset management industry is currently the most in need of such real-time data solutions.

Industries Where Real-time Data Infrastructure and Analytics Solutions Are Mostly Adopted

Processes Data for More Than 250 Asset Managers With a Combined AUM of Over $10 Trillion

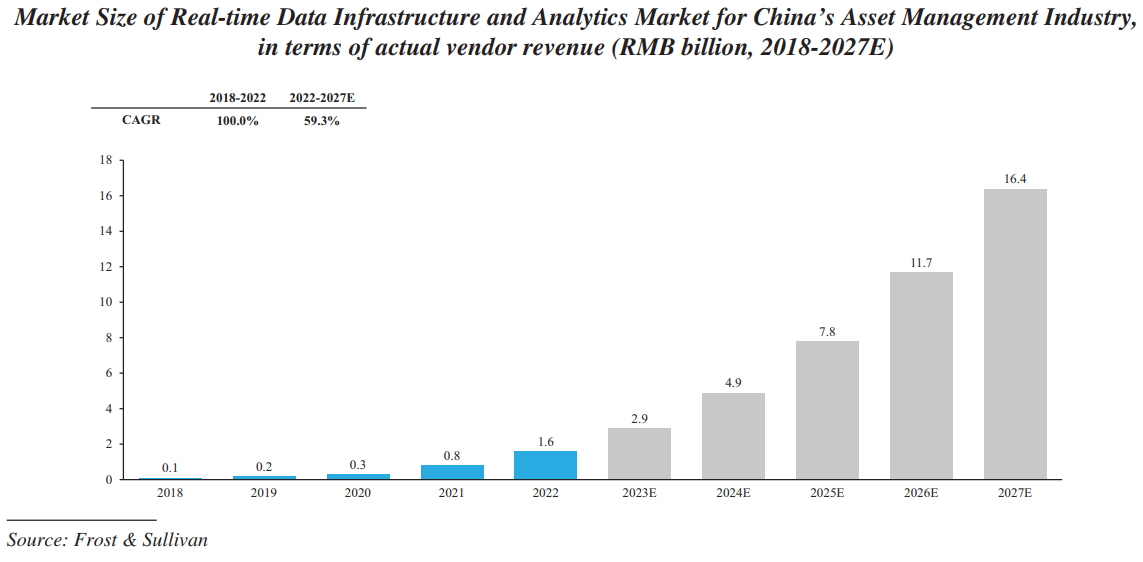

China's asset management industry has seen rapid growth, with assets under management (AUM) surging from RMB 308.8 trillion in 2018 to RMB 413.2 trillion in 2022, and projected to reach RMB 671.3 trillion by 2027.

This has fueled demand for real-time data infrastructure and analytics solutions tailored for asset managers. According to Frost & Sullivan, the market size for such offerings in China's asset management space surged from RMB 0.1 billion in 2018 to RMB 1.6 billion in 2022, and is forecasted to reach a staggering RMB 16.4 billion by 2027 - a compound annual growth rate of 59.3%.

However, the burgeoning market remains vastly underserved. The TAM size for real-time data analytics in China's asset management industry stood at RMB 50.9 billion in 2022 and is expected to more than double to RMB 130.2 billion by 2027, growing at a 20.7% CAGR based on asset managers' projected IT budgets. This implies the sector had a mere 3.1% penetration rate in 2022, signaling massive headroom considering the RMB 130.2 billion projected TAM by 2027.

As the leader in this segment, Xunce has undoubtedly experienced strong growth, with a client base that includes China's top ten asset management companies in terms of assets under management as of the end of 2022, including insurance giants and mutual funds.

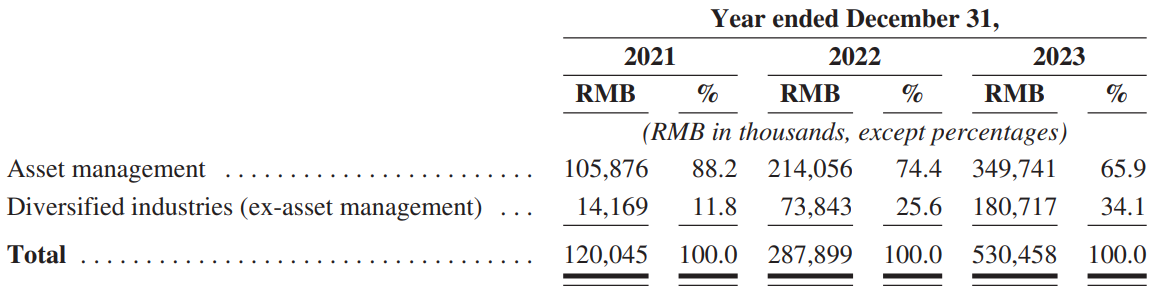

Since its inception in 2016, the company has handled data for over 250 asset managers with a combined over $10 trillion in AUM. The asset management vertical is Xunce's largest revenue driver, contributing 65.5% of its total RMB 530.5 million revenues in Q1 2023. In comparison, revenue from the non-asset management industry was RMB 180.7 million, accounting for 34.1% of total revenue.

Frost & Sullivan ranks Xunce first in terms of revenue and market share of real-time data solutions in China's asset management industry in 2022, with a market share of over 13%.

Beyond the two major real-time data infrastructure solutions (DOne and VOne), Xunce has launched five specialized solutions on the application level for asset managers so far: POne, XOne, TOne, COne and ROne.

Source: IPO file

POne, launched in 2021, helps asset managers identify portfolio returns, risk exposure and performance attribution. It also incorporates insights for business decision-making and market analysis by discerning patterns, evaluating market trends, and assessing competitive landscape.

XOne, launched in 2017, offers functions including order execution and management, real-time position monitoring and forecast, fund settlement management, company behavior monitoring, and collateral management and risk analysis.

TOne, launched in 2021, provides functions including real-time asset bookkeeping and accounting based on initial position, asset data and settlement flow changes, analyzing transaction data such as instructions, orders, trades, and settlements to perform whole-product accounting processing, generating position, market value details, and product-specific valuation indicators.

COne, launched in 2022, specializes in real-time comprehensive risk monitoring over multiple asset classes and provides integrated risk management from pre-investment, mid-investment, to post-investment.

ROne, launched in 2022, is designed for regulated financial institutions featuring data management and reporting tools, allowing the institutions to import and export compliance reports, and verify data.

Path to Profitability Remains an Uphill Battle for Xunce

Despite experiencing significant revenue growth, Xunce continued to operate at a loss, driven by substantial investments in R&D and business expansion.

Revenue surged from RMB 120 million in 2021 to RMB 287.9 million in 2022, further escalating to RMB 530.5 million in 2023. During this period, Xunce allocated a noteworthy portion of its revenue to R&D expenses, representing 127.0%, 89.9%, and 71.5% in 2021, 2022, and 2023, respectively.

Unsurprisingly, the company reported net losses of RMB 119.0 million, RMB 96.5 million, and RMB 63.4 million in 2021, 2022, and 2023, respectively.

The company cited prioritizing revenue growth over immediate profitability to gain market share and premium customers, a strategy common among peers.

Xunce also recorded net operating cash outflow during 2022 and 2023, and expects such positions to continue until it achieves a greater scale. Citing Frost & Sullivan, the company said that real-time data infrastructure and analytics providers at a similar stage of development as itself will generally experience operating losses in China.

The company’s active customer base has expanded from 143 in 2021 to 200 in 2023, with average revenue per user (ARPU) climbing from RMB 839,000 to RMB 2.7 million over the same period.

On the monetization front, Xunce adopts a flexible, modular pricing approach based on factors such as the number and type of solutions required, processing speed, customization needs, and market dynamics. Clients can opt for either a subscription model with annual fees or a transaction-based model with one-time setup charges. Both revenue streams have seen healthy growth, with subscriptions rising from RMB 80.8 million in 2021 to RMB 203.2 million in 2023, and transaction revenues soaring from RMB 39.2 million to RMB 327.2 million.

However, high customer concentration remains a concern: the top five customers account for more than one-third of total revenue in both 2022 and 2023, while on the other hand, a staggering 90% of Xunce’s sales come from mainland China.

Breakdown of Xunce’s Revenue by Industry Application

To address these vulnerabilities, the firm is actively diversifying beyond its traditional asset management stronghold into new verticals. The non-asset management segment's contribution to total revenues has surged from a mere 11.8% in 2021 to 34.1% in 2023, reflecting Xunce's concerted pivot.

Source: IPO file

According to Frost & Sullivan, actual vendor revenues in China's real-time data infrastructure and analytics market outside of the asset management industry have been growing rapidly and are expected to reach RMB 53.4 billion in 2027, with a CAGR of 43.7% from 2022-2027.

Xunce, recognizing the need to reduce its dependency on the domestic market, is actively pursuing international expansion, targeting the Asia-Pacific (including Hong Kong) and EMEA regions. Frost & Sullivan estimates a combined $5.55 billion opportunity for asset management analytics in these regions by 2027.

Early forays into overseas markets have yielded promising results, with Hong Kong contributing 9.9% of total revenues in 2023, up sharply from just 1.4% in 2021, as the firm supports its clients' global investment strategies.

However, steering this high-stakes diversification while curbing losses remains an uphill battle amid intensifying competition and market shifts. Xunce's ability to strike the right balance between strategic bets and fiscal prudence will be pivotal in determining its path to sustainable profitability.

来源:DataYuan

我要评论

不容错过的资讯

大家都在搜