Turning Code into Cash: China’s Open-Source DB Biz Challenge...

原创 Vera | 2025-07-03 22:11

【数据猿导读】 As the digital economy booms, databases—those silent workhorses storing and processing the world’s data—are evolving fast. And in China, open-source databases are at the forefront of that shift. Pushed by national goals of ...

As the digital economy booms, databases—those silent workhorses storing and processing the world’s data—are evolving fast. And in China, open-source databases are at the forefront of that shift. Pushed by national goals of technological self-reliance, Chinese developers are moving fast and breaking ground. But one question still looms large: how do you make money from software you’re giving away for free

Why Open-Source Is Booming—But Still Hard to Implement

Open-source has gone mainstream in China’s tech industry, and database systems are very much part of that movement. Today, open-source communities have become a go-to place for technical personnel, which help build trust and increase communication efficiency significantly. For basic software vendors, open-source is an inevitable choice. When both sides of a partnership can see the code, track development in real time, and interact in open forums, it removes the fear of vendor lock-in. That transparency lets everyone focus on what matters—building real features, understanding the market, and co-developing products with customers from the ground up.

Peter Levine, an entrepreneur and former Senior Vice President of Cloud Services and Data Centers at Citrix, once proposed that “the history of open source highlights that its rise is due to a virtuous cycle of technology and business innovation… The full potential of open source is only realized when technological innovation is paired with commercial innovation.” Commercialization and open-source communities are beneficiaries of a win-win outcome. For the daily operation of open-source communities, commercialization can support the maintenance and management of open-source communities, cover expenses such as developer groups, technical facilities, and training, therefore achieve the sustainable development of the community. In turn, thriving open-source communities expand the market footprint for commercial offerings.

The combination of open-source and commercialization is creating a more free and diverse professional ecosystem for developers. It carries the vision of many independent developers: to achieve value returns through open collaboration and continuous innovation without relying on large organizations. To achieve this, only the deep integration of the open-source mechanism and a sustainable business model can make it a reality.

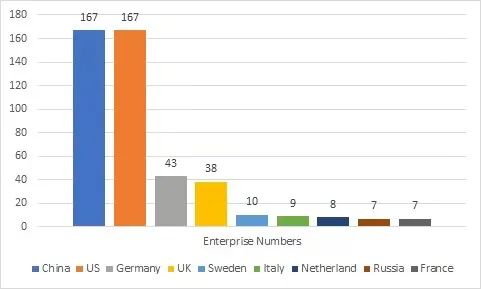

Chinese open-source database communities such as TiDB and openGauss have made remarkable progress in technological innovation as well as industry application. According to the "2024 Trusted Database Development Conference," China’s database market has grown to over 52.24 billion yuan (around $7.2 billion USD). As of June 2024, there are 518 database product providers globally, with China and the United States leading the way—each home to 167 companies, accounting for 32.2% of the global total.

Enterprise Numbers

Global Distribution Ratio of Database Enterprises

Source: CCSA TC601 Big Data Technology Standards Promotion Committee, June 2024

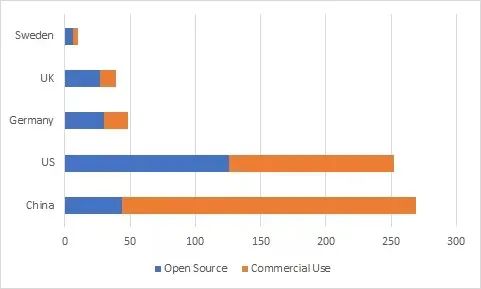

In the United States, open-source and commercial database vendors are split roughly down the middle. In China, however, the distribution skews heavily toward commercial offerings—a striking 83.6% of database companies are commercially oriented, while only 16.4% are open-source. That gap underscores the untapped potential for open-source databases to grow in China in the years ahead.

Source: CCSA TC601 Big Data Technology Standards Promotion Committee, June 2024

China's database market is growing rapidly, but globally, foreign vendors still dominate the commercial space. According to a report by China Daily, in 2024, China’s commercial database market accounts for just 7.6% of the global total, while foreign commercial databases such as Oracle and SQL Server still dominate more than 70% of the market share.

For large enterprises, databases are core systems related to business security and continuity. Compared with commercial databases such as Oracle, IBM DB2, and SQL Server—which have had decades to mature and entrench themselves in enterprise stacks— China's domestic open-source products still struggle to prove they can scale reliably in commercial environments. That makes large-scale migration a hard sell. At the same time, open-source databases often get stuck in a familiar trap: after years of being seen as “free by nature,” they struggle to convince users to pay—even when the service is solid.

Viewing it from the scale of technical service, the current profit model of mainstream open-source databases still rely on "labor-intensive" offerings such as technical support, customized development kits, and operation and maintenance services. However, this model is limited by human resources and delivery capabilities, making it difficult to scale or replicate efficiently.

Striking a balance between standardization and customized client needs remains a major challenge for vendors. Compared with mature open-source communities in Europe and the United States, China's local open-source ecosystem is still in its early stage—lacking sustained investment and well-established feedback loops in areas like community operations, developer incentives, and standards development. As a result, enterprises often spend a lot of money investing in the ecosystem, but hard to earn revenue from it.

Typical Cases: Monetization Paths of TiDB, openGauss, and Other Vendors

Despite the difficult environment, some leading open-source database vendors in China are still exploring feasible commercial paths. Notably, TiDB and openGauss have each taken distinct approaches: from “technology plus cloud services,” to “policy-driven and scenario-based offerings,” to “security compliance wrapped in proprietary tech.”

TiDB is an open-source distributed relational database independently designed and developed by PingCAP. It is also one of the earliest distributed database projects in China to gain global traction. Technically, TiDB is known for supporting HTAP (Hybrid Transactional and Analytical Processing)—a system that enables both real-time transactional processing and analytical queries in a single architecture. By merging these workloads within one unified engine or collaborative framework, TiDB minimizes data duplication and latency.

On the business side, PingCAP has moved beyond the typical “sell support services” model that many open-source projects rely on. By launching the TiDB Cloud platform, it packages database products into subscription-based "Database as a Service (DBaaS)" and provides lightweight versions such as Serverless Tier to reduce use threshold for customers. At the same time, PingCAP has also built TiDB Playground for developers to try out for free, encouraging a natural path from exploration to paid adoption. As of April 2025, TiDB has provided services to more than 4,000 leading enterprises from more than 25 countries and regions around the world, covering many key fields such as finance, telecommunications, manufacturing, energy, catering, medical care, and the Internet.

More strategically, TiDB has been doubling down on scenario-based customization. For example, it created a "database laboratory" with Yum China. For the obvious peak and valley scenarios in the catering industry, TiDB optimizes the performance of the order peak period of KFC's weekly discount day "Crazy Thursday" operated by Yum to help customers achieve cost reduction and efficiency improvement. In the international market, TiDB is also expanding its business in Japan, Southeast Asia, and North America and providing tailored services for compliance requirements such as GDPR (General Data Protection Regulation). In many ways, TiDB is borrowing a page from global players like Snowflake and MongoDB—positioning itself to build a product-led, service-backed business model that scales sustainably.

In contrast, openGauss is more closely aligned with China’s domestic tech substitution strategy. As an open-source database project led by Huawei, openGauss is built on PostgreSQL, emphasizing self-reliance and control. With strong policy backing, its path to commercialization is clearer. According to the research data of Frost & Sullivan, an American business consulting firm, in 2024, openGauss won a 30.2% in the "offline centralized relational database" market. Its enterprise distribution version accounted for 28.5% of relational database deployments, surpassing both MySQL and PostgreSQL to become the top open-source route—and a clear front-runner in China’s domestic alternatives landscape.

In terms of commercial application, openGauss has joined hands with DingTalk to launch an all-in-one AI vector database appliance—integrating the engine with higher-layer applications to streamline deployment and simplify operations. at the same time, it also collaborated with China Mobile to release the "PanWeiDB All-in-One Machine," enabling minute-level deployment for small and mid-sized businesses, especially those lacking technical staff and experience. In addition, openGauss has also promoted the national "Basic Software Hundred Schools Seed Plan," jointly training more than 40,000 database talents with universities, laying a foundation for the sustainable development of the ecosystem.

If TiDB represents the “startup model”—a product- and tech-driven company scaling toward a global footprint—then openGauss is more like a "national team player" led by policies and deeply embedded in government procurement channels, regulatory alignment, and standardized ecosystem-building.

What China Can Learn from International Open-Source Companies

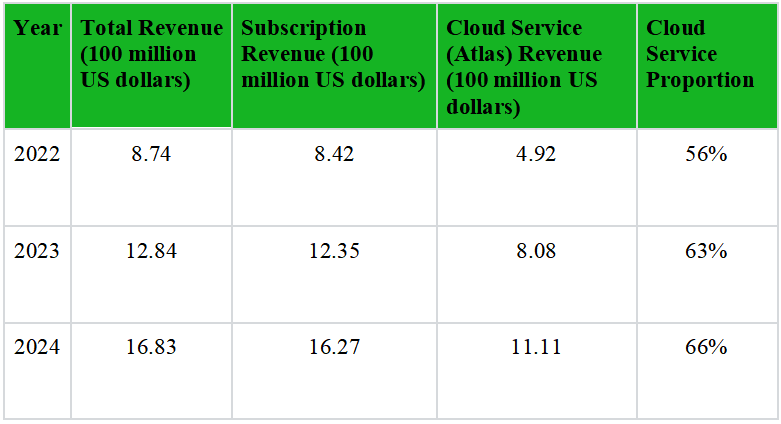

From an international perspective, open-source database vendors such as MongoDB, PostgreSQL, and Redis Labs have largely adopted a commercial strategy based on the “Open Core + Cloud Services” model. In this approach, core code is open to the community, while the enterprise version and value-added tools are packaged and sold as commercial offerings. MongoDB is perhaps the most representative example of this model— its revenue evolution over the past three years clearly illustrates how the open-source community maintains the free core product, while the enterprise edition generates stable income through extended features and managed cloud services. The share of revenue from services continues to rise, creating a self-reinforcing business loop. By comparison, many Chinese open-source database vendors are still in the early stages, and some projects have not even achieved sustainable revenue.

MongoDB Financial Data (2022–2024, Unit: 100 million US dollars)

Source: MangoDB Financial Report

But China is not without advantages. Thanks to the twin forces of diverse real-world deployment scenarios and strong policy support, local open-source databases have a market with significant depth and long-term potential. At present, the substitution of databases in industries such as finance, telecommunications, energy, government, medical care, and transportation is accelerating in an all-round way. Taking openGauss as an example, it has achieved stable deployment in the Ministry of Industry and Information Technology, the State Taxation Administration, some joint-stock banks, and the three major mobile operators. OceanBase is another standout—it has doubled its customer base for four consecutive years, driven by its dual public and private cloud engines, with major deployments at Postal Savings Bank of China, China UnionPay, and Ant Group.

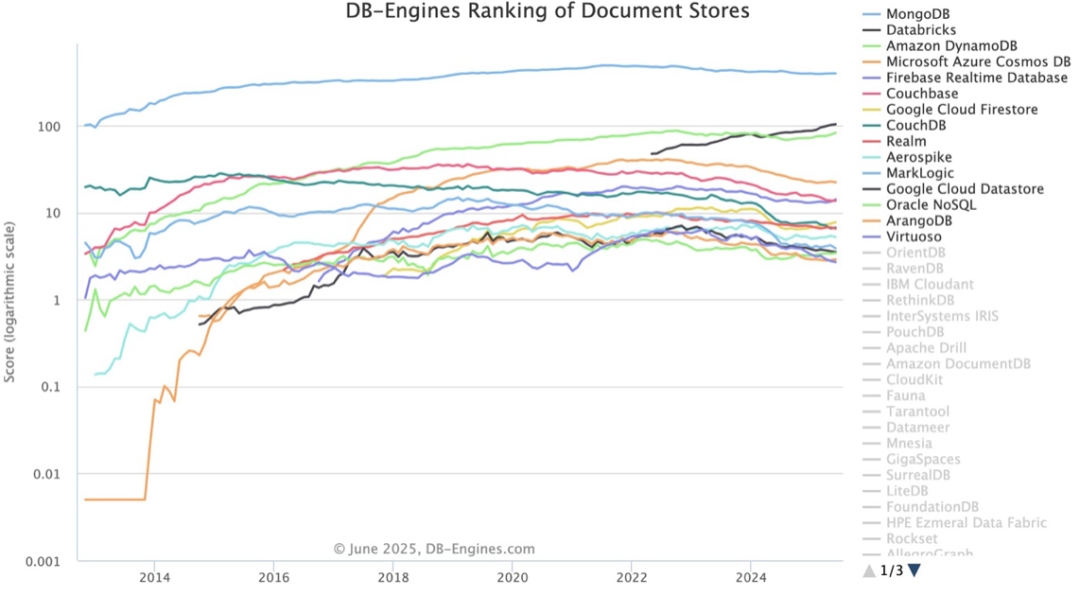

DB-Engines Document Storage Ranking

Source: DB-Engines.com, June 2025

The Road Ahead for China's Open-Source Databases

Facing challenges, China's open-source database community is trying to explore diversified business models. A sustainable path forward may emerge from three key areas:

First, is deeper investment in technology and collaborative innovation in the ecosystem. Projects such as TiDB and openGauss have launched the research and development of next-generation database technologies, such as fully encrypted databases, vector databases, and HTAP architecture upgrades, which not only respond to user performance and security needs but also help form technical barriers. At the same time, integrating resources through open-source foundations such as the OpenAtom Foundation and promoting cross-enterprise collaboration and community activity will help form a more vibrant technical ecosystem.

Second, a shift toward platform-based product offerings. Inspired by Snowflake’s usage-based pricing model, Chinese vendors are beginning to experiment with pay-as-you-go billing, coupled with AI-driven automation tools for operations and maintenance. Vertical scenarios are mutually integrated, and "database + industry" solutions are launched for vertical industries such as medical care, transportation, and manufacturing. For example, openGauss has partnered with Sinosoft to co-develop medical all-in-one machines, achieving a 5-fold improvement in operation and maintenance efficiency.

Finally, building out a complete ecosystem and commercial model. As a key area of information technology innovation, databases will continue to receive policy support in the future. Databases based on BSD-style open-source licenses—which allow for both openness and proprietary commercialization—are becoming preferred options in government procurement. This structure enables vendors to retain self-reliance and control, while still monetizing their products and expanding their market reach.

Policy-wise, local governments and financial departments have introduced tangible incentives to support the development of domestic databases. In Beijing, companies can receive subsidies of up to 10% of the actual procurement amount, up to 30 million yuan, for being the first to successfully implement solutions in key industry scenarios. The city has also established a dedicated “database” product category in its procurement system, giving a reward of 250,000 yuan to each of the top 20 projects. In addition, at the end of 2023, the Ministry of Finance and the Ministry of Industry and Information Technology jointly issued the government procurement standards for desktop computers, servers, and database products, clearly incorporating security and reliability evaluation requirements into the procurement scope of party and government organs above the county and township level, creating a larger market space for domestic databases.

On the talent side, professional certification systems (such as PGCA and TiDB developer certification) are playing an increasingly important role in upgrading the industry. Through school-enterprise cooperation, training platforms, and other means, the skill base of practitioners is steadily improving, ensuring a stronger talent pipeline for the promotion and deployment of domestic databases.

In the long run, the key to commercializing open-source databases lies in earning users’ willingness to pay for real value—not simply because the products are domestic, or backed by policy support. Only with outstanding product quality, standardized services, and a healthy ecosystem can China’s open-source databases evolve from backup options into world-class infrastructure competitors.

来源:数智猿

刷新相关文章

我要评论

不容错过的资讯

大家都在搜